Running an insurance agency or company means competing for attention in today’s packed insurance market, but here’s some encouraging news:

68% of insurance shoppers don’t have a specific company in mind when they start searching.

(image source #1)

Your digital marketing approach determines whether those prospects become clients or slip away to competitors. This guide covers the insurance marketing fundamentals:

Strategic advertising, SEO, social media that builds trust, real-world examples, how AI is changing things in 2025, and more.

Let’s show how you can capture those undecided shoppers and grow your customer base, thanks to the right marketing strategy.

Creating an Effective Insurance Advertising Plan

Let’s begin by looking at the practical pieces you’ll need to put your plan together, from the words on the page to the platforms you choose.

What should you include in an advertisement for an insurance company?

Your ad needs to answer the question people ask themselves when they see it: “Do these people understand what I’m going through?”

The parent shopping for life insurance wants to know you’ve helped families like theirs. The business owner needs to see that you’ve protected companies in their situation.

(image source #1)

Brand Awareness and lead generation happen when you connect with your target audience at the right moment in their customer journey. Since 88% of insurance customers want personalized messaging, your ad should speak directly to that specific person’s world, not everyone’s.

Four elements separate ads that work from those that get ignored:

• A Clear Value Proposition: “We cover what State Farm won’t” or “Get covered in 5 minutes, not 5 weeks”

• An Emotional Connection: Show the family barbecue, the successful business opening, the couple moving into their dream home

• Social Proof: Display online reviews like “They paid my claim in 3 days” with real customer names and photos

• A Simple Call-to-Action: “Get your quote in 60 seconds” works better than “Learn more about our comprehensive solutions”

Google ads for insurance agents

Google Ads for insurance puts you in one of the most competitive spaces in digital advertising, but here’s the upside:

When that new cafe owner desperately needs liability coverage before their grand opening, your paid search campaign becomes their perfect solution if you’ve targeted them with laser precision.

(Image source #1)

The numbers tell an exciting story: the average insurance consumer spends $867 after a search, so capturing just a few of the right clicks can make your entire month profitable.

Google Search loves companies that get specific with local keywords like “restaurant liability insurance in Toronto” because these phrases connect you with people who know exactly what they want.

Building Your Campaign

Your Google Ads success depends on these key elements:

- High-Intent, Long-Tail Keywords: Target specific phrases like “commercial auto insurance for contractors in Vancouver” that show clear buying intent

- Maximize Ad Extensions: Call Extensions let prospects phone your agency directly, Sitelink Extensions can direct visitors to your home insurance and business coverage pages, and Review Extensions display your client testimonials and ratings

- Connect to Google My Business: Link your Google My Business profile to build local trust and show prospects you’re a real insurance office in Calgary or Montreal that they can visit

Pro Tip

At Nomadic Advertising, we help insurance companies avoid the expensive mistakes that come with managing Google Ads in such a crazily competitive space. Our specialized approach prevents wasted ad spend and gets you profitable results faster.

Insurance ads on Facebook

While Google Ads captures people actively searching for coverage, Facebook operates in a completely different universe where your prospects are scrolling through family photos and catching up with friends. Your insurance display ads need to interrupt that social mindset without feeling pushy.

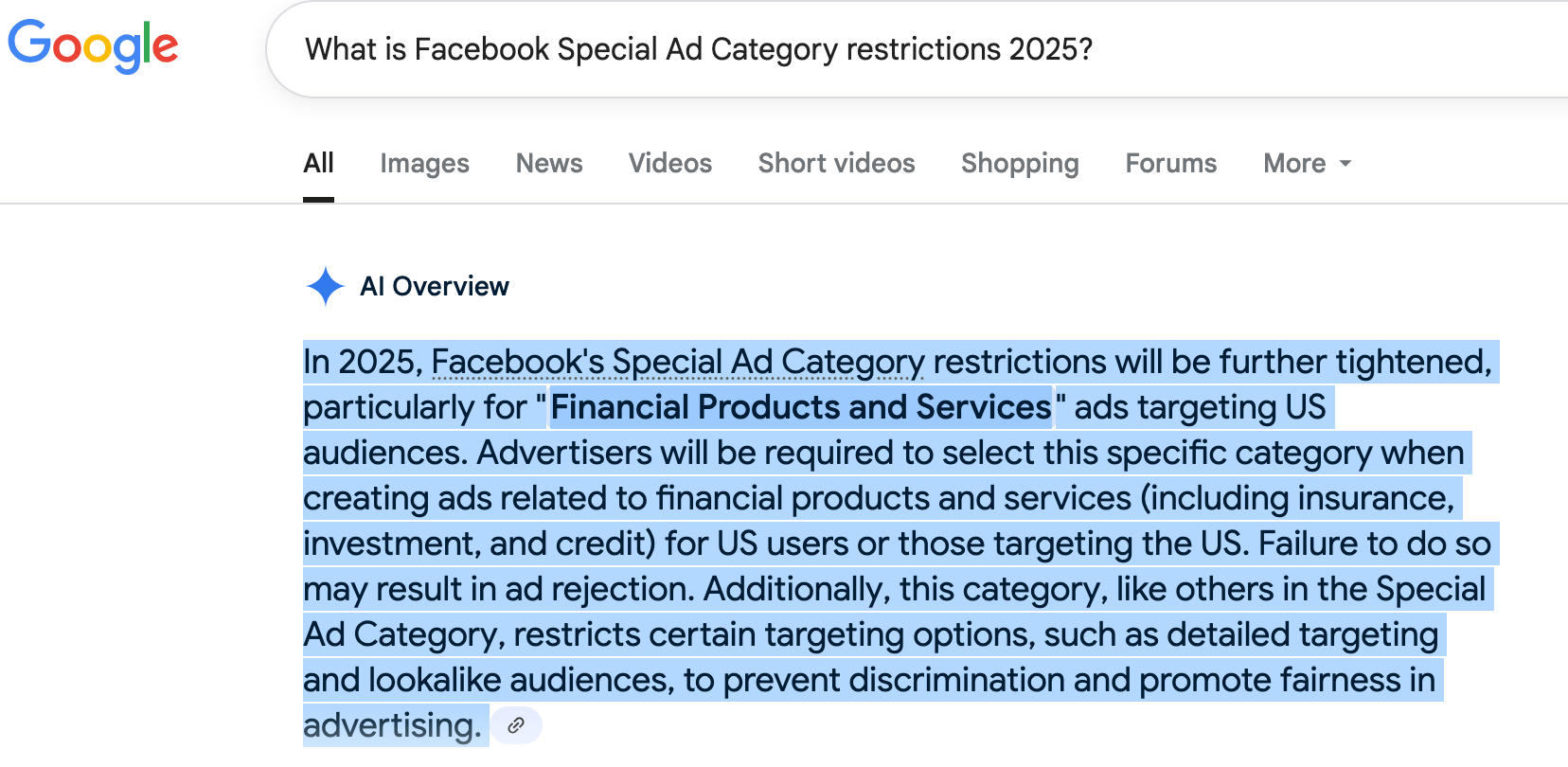

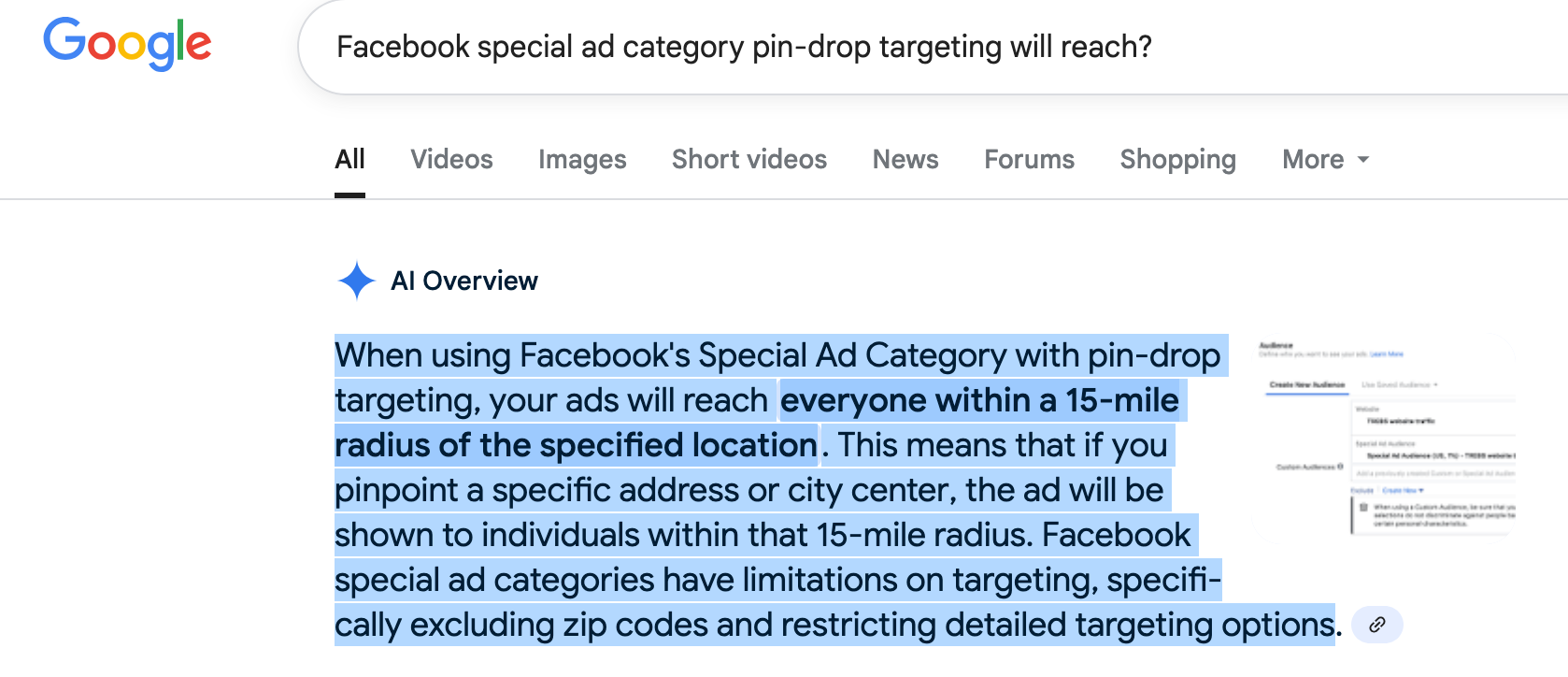

Facebook’s Special Ad Category restrictions limit your targeting options, so your success on Facebook requires patience and a three-part strategy:

1) Start with helpful content:

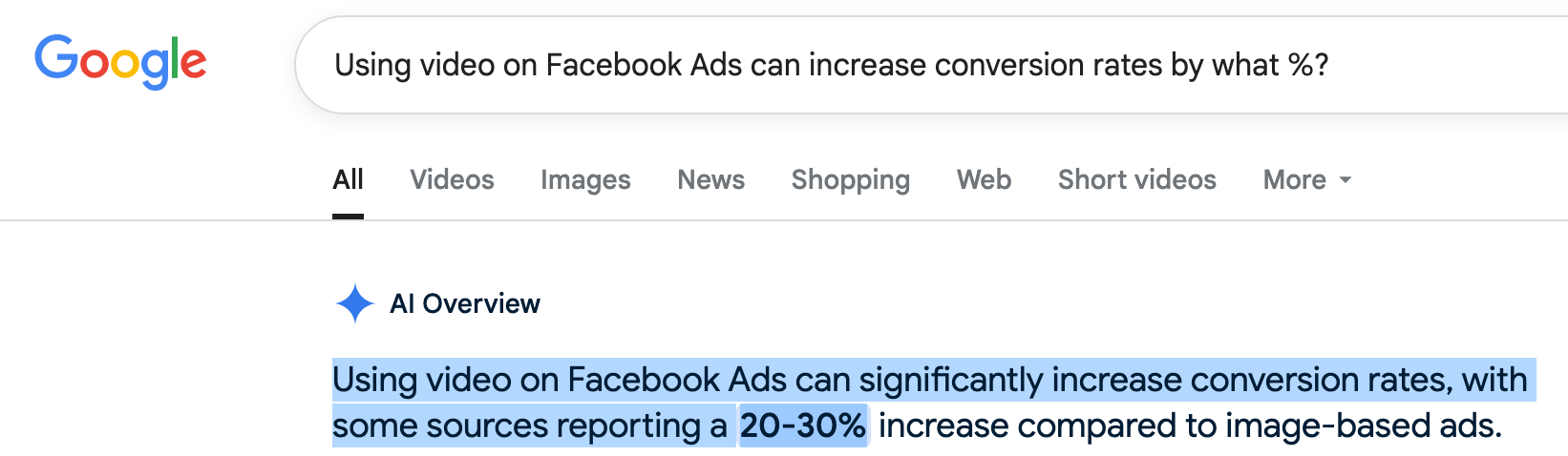

Create video marketing content that speaks to specific customer personas facing life events, like “5 things new homeowners in Edmonton should know about insurance.” Video on Facebook Ads can increase conversion rates by up to 30%, making this your most powerful first impression.

2) Make it easy to respond:

Facebook’s Instant Forms let you capture leads from your engaged audience with low-commitment offers like free guides or quick assessments

3) Have real conversations:

Messenger ads can turn those leads into personal conversations. Instead of pushing for a sale, you might help a young family in Calgary understand their life insurance options, positioning yourself as their trusted advisor.

Pro Tip

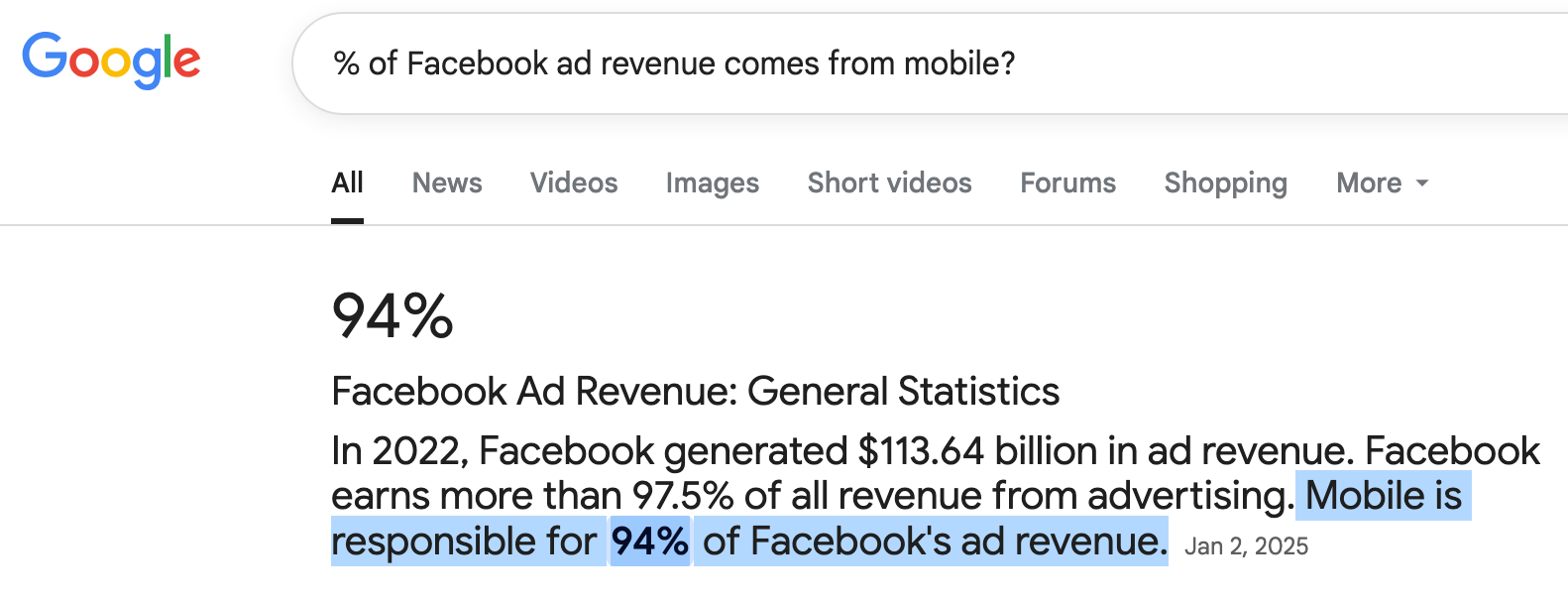

Since mobile is responsible for 94% of Facebook’s ad revenue, your social media posts need to work perfectly on smartphones, where most people consume content.

At Nomadic Advertising, we’ve spent over 10 years perfecting Facebook Ads, especially dealing with those tricky Special Ad Category restrictions. Our hands-on experience means fewer headaches and faster results for your campaigns.

Creative Insurance Advertising Ideas to Attract More Clients

Competing against over 4,700 active insurers in the US market while sending out the same “we offer great coverage at competitive rates” message simply won’t cut it anymore.

In 2025, your company should also try disruptive advertising ideas that break away from traditional insurance thinking. Let’s look at some of them.

Parametric Insurance Marketing:

Instead of complex policy explanations, some companies now market along the lines of: “If a hurricane hits, you get X amount of dollars by Friday.”

(Image source #2)

Example: Blink Parametric automatically pays flight delay customers without filing claims, proving this concept works in the real world.

Climate Prevention Marketing:

Rather than just selling coverage, forward-thinking agencies offer “disaster-proofing” with incentives like “We’ll inspect your roof and give you $500 toward fire-resistant materials.”

(Image source #3)

Example: The company Travelers partners with Wildfire Defense Systems (WDS) to provide private fire crews to protect insured homes.

Prevention-First Partnership Marketing:

Smart agencies position themselves as wellness partners, marketing health perks alongside coverage.

(Image source #4)

Example: John Hancock’s “Vitality” program rewards healthy activities with discounts and gift cards, creating genuine relationships with clients.

Usage-Based Real-Time Marketing:

Progressive agencies also make savings immediate with “Save money this month by driving better when using our app.”

(Image source #5)

Example: Root Insurance’s “test drive” model uses insurance technology to base quotes on how people drive, not demographics.

Great Insurance Ads Examples: What Works and Why

Speaking of real world examples, let’s look at some Insurance advertising campaigns we loved.

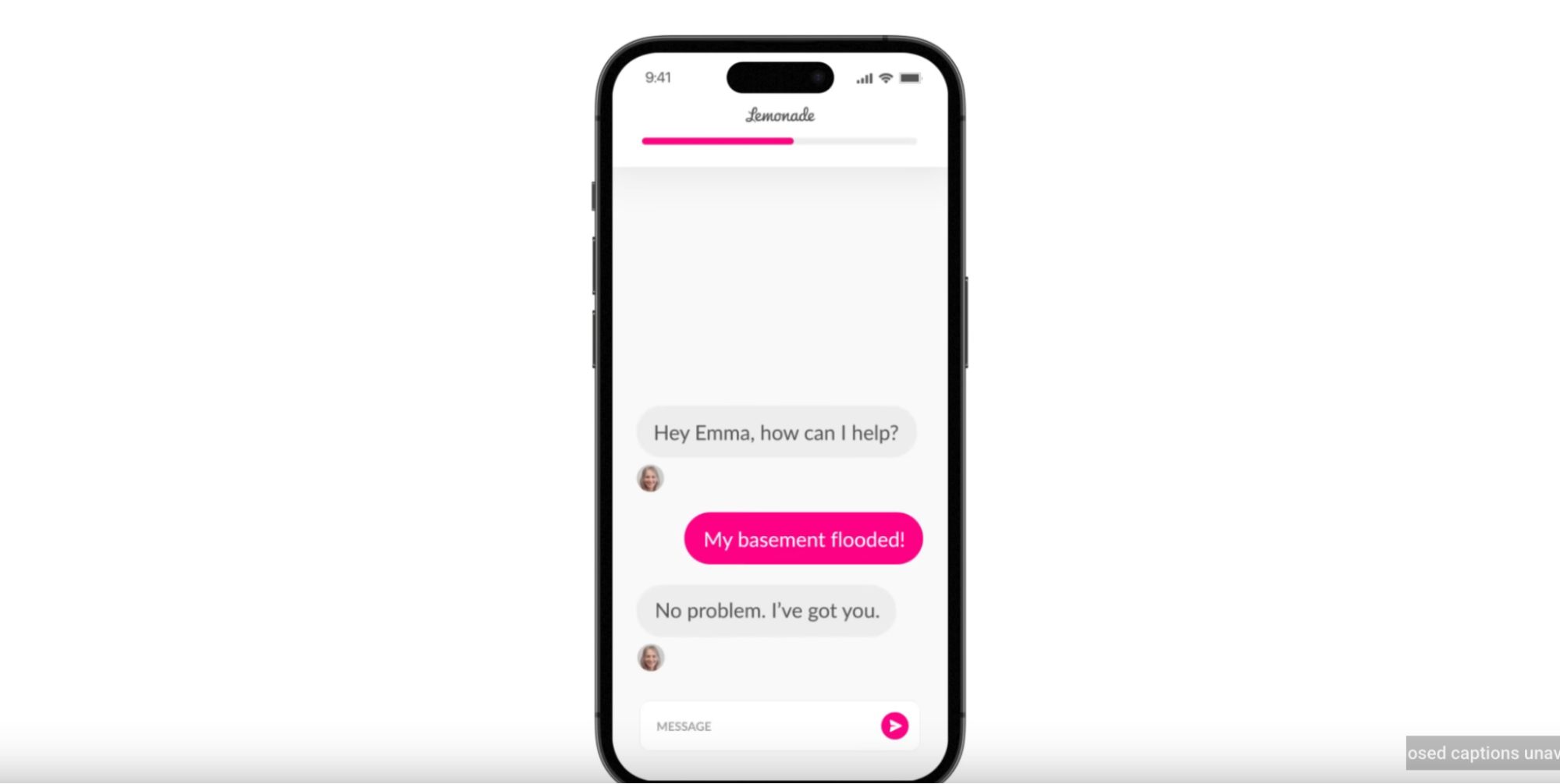

1 – Lemonade Insurance on YouTube

(Image source #6 – for all three images)

Wellington

Lemonade’s 30-second ad shows a cat in Wellington boots while its owner stands in her flooded basement, stuck on hold with her insurance company.

The visual perfectly captures that sinking feeling when customers need help but get endless hold music.

Why It Worked

This campaign hit 400k YouTube views because it tapped into a universal customer frustration. The contrast between the woman’s helpless waiting and Lemonade’s instant solution made viewers see the difference immediately.

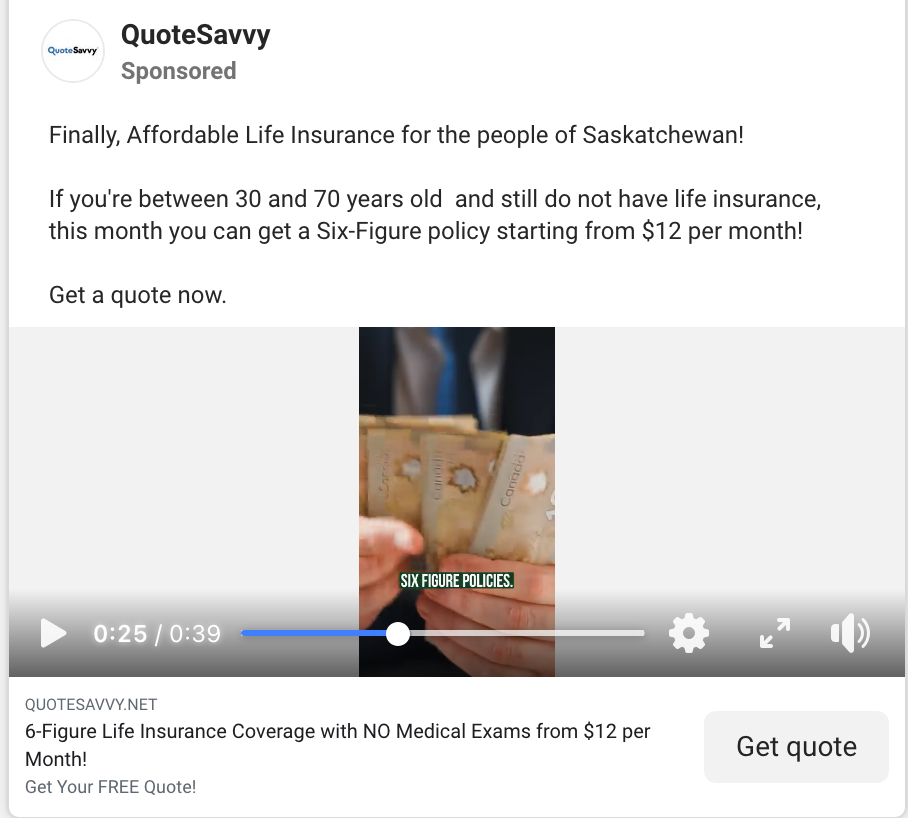

2 – QuoteSavvy on Facebook

(Image source 7 – for all images)

What They Did:

QuoteSavvy paired specific, benefit-focused copy with a 40-second video ad below it, targeting Saskatchewan with Facebook’s 15-mile (25 km) radius requirement for industries like Insurance.

Why It Worked:

Their copy hit three pain points: location (“people of Saskatchewan”), urgency (“still do not have”), and affordability ($12/month for six figures).

Since over 80% of people scroll social media with sound off, QuoteSavvy also added captions to their video so their message came through either way. Meanwhile, Facebook’s radius restrictions for Insurance actually helped them reach more people across Saskatchewan than precise zip code targeting would allow.

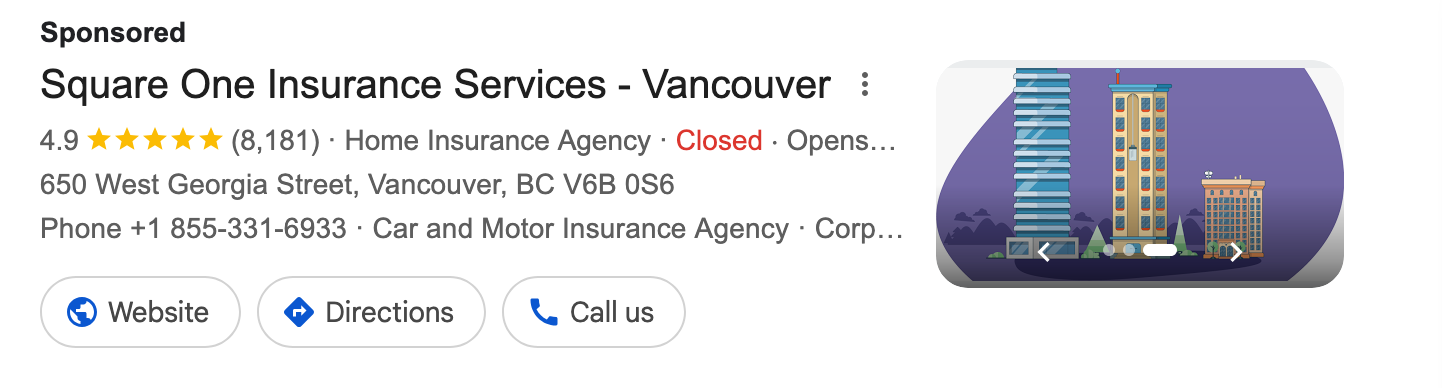

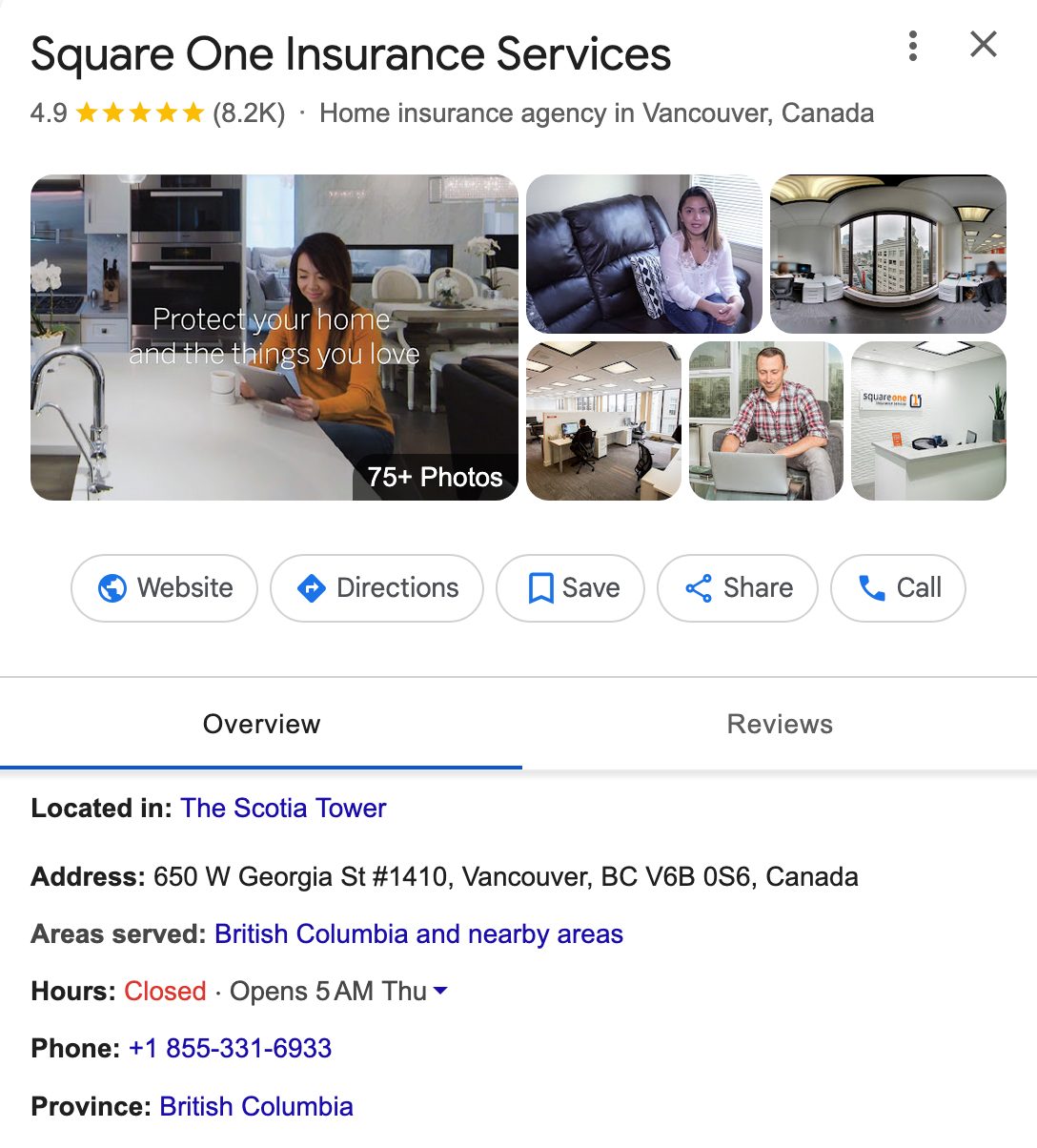

What They Did:

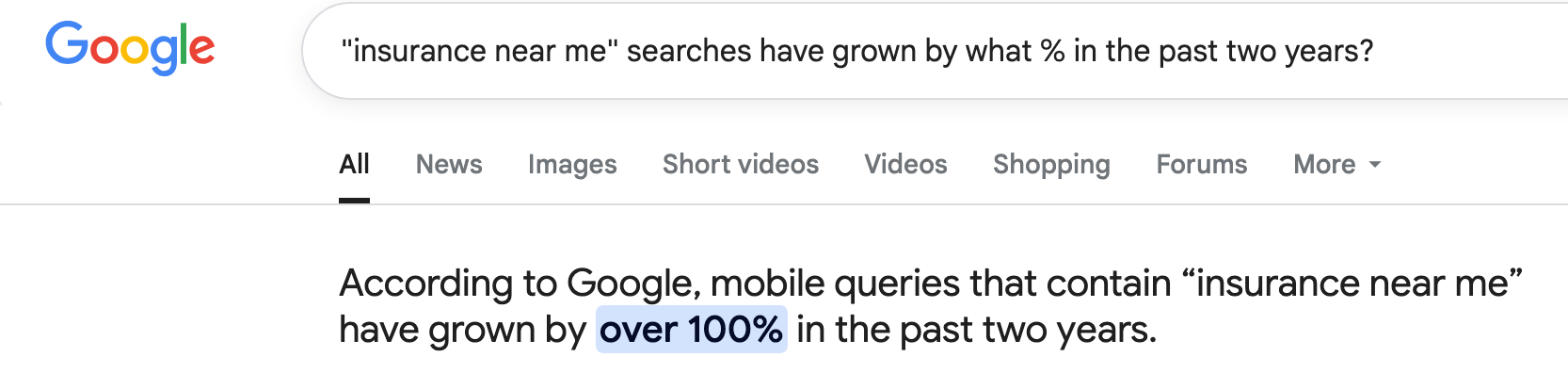

Square One Insurance built its Google Ad campaign around its massive 4.9-star rating from over 8,000 reviews, targeting Vancouver and British Columbia. When users click their ad, it opens their Google My Business profile, showing 75+ photos and videos of testimonials, their staff, office space, and workplace culture.

Why It Worked:

Those 8,000+ reviews create instant trust, most people won’t even consider an insurance agency without stellar social proof. The 75+ photos and videos from happy customers also do something clever: they show real faces and real offices instead of generic stock imagery, making Square One feel like people you could walk in and talk to.

SEO for Insurance Agencies: Boosting Visibility and Rankings

Most people hit Google when they need insurance coverage, and in 2025, being buried on page two might as well be invisible. Search Engine Optimization gets you into those important top 5 spots through keyword research, content marketing, and technical work that makes Google rank your site higher in the insurance industry.

Let’s look at two parts of SEO that can make a difference for your Insurance company.

The Role of Insurance Content Marketing in Your Strategy

What’s changed dramatically is Google’s AI Overview feature, which can now show your content when people ask insurance questions. Getting featured in these AI-generated responses has become absolutely critical for staying visible when prospects search for coverage.

Your Content strategy should focus on these high-impact formats:

- Long-form pillar pages: Comprehensive guides like “Complete Guide to Auto Insurance in Calgary” or “Everything Alberta Business Owners Need to Know About Liability Coverage”

- Targeted blog posts: Answer specific questions, such as: “What happens if I don’t have tenant insurance in Toronto?”

- Video content marketing: Complex topics like “How deductibles work” become much clearer when you can show visual examples

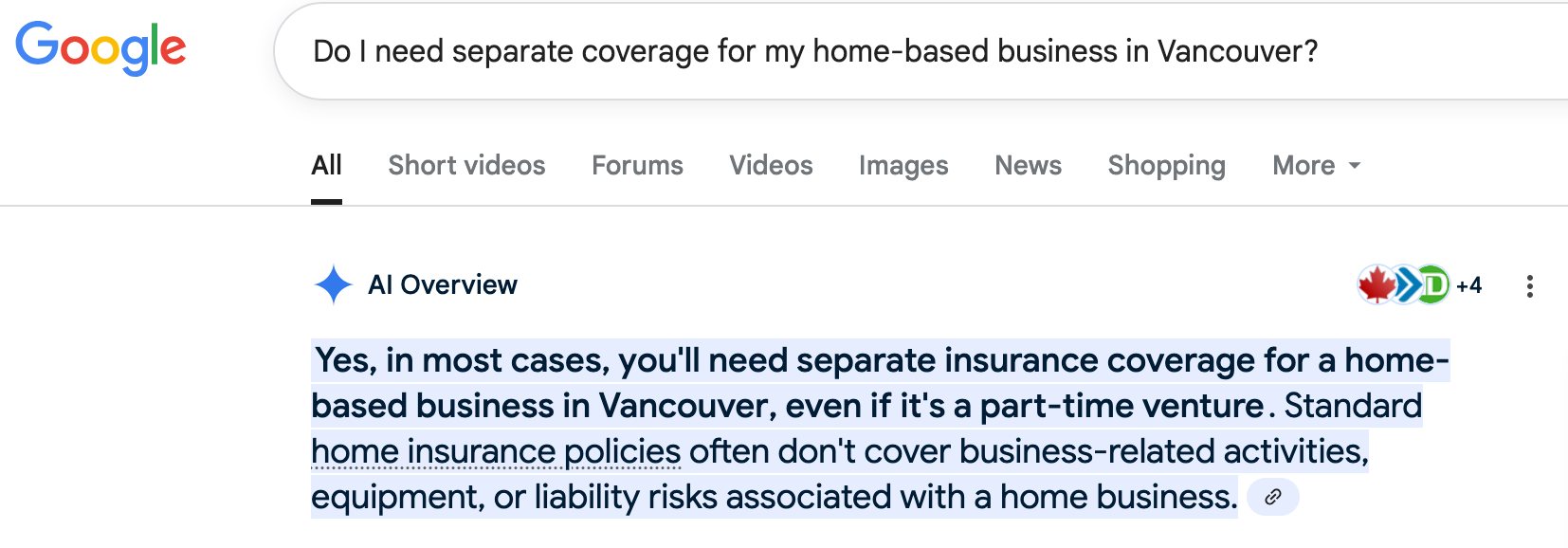

Here’s a real-world example of what happens when you ask Google: “Do I need separate coverage for my home-based business in Vancouver?”

The AI Overview gives you this:

What Google does is cleverly synthesize its answer from blogs it trusts the most. If we click on the “link” icon on the bottom right of it, we can see the blogs it cites:

So, in 2025, it’s an absolute must to be a source Google trusts to answer these key questions your Insurance prospects are asking, and your content marketing is at the heart of it.

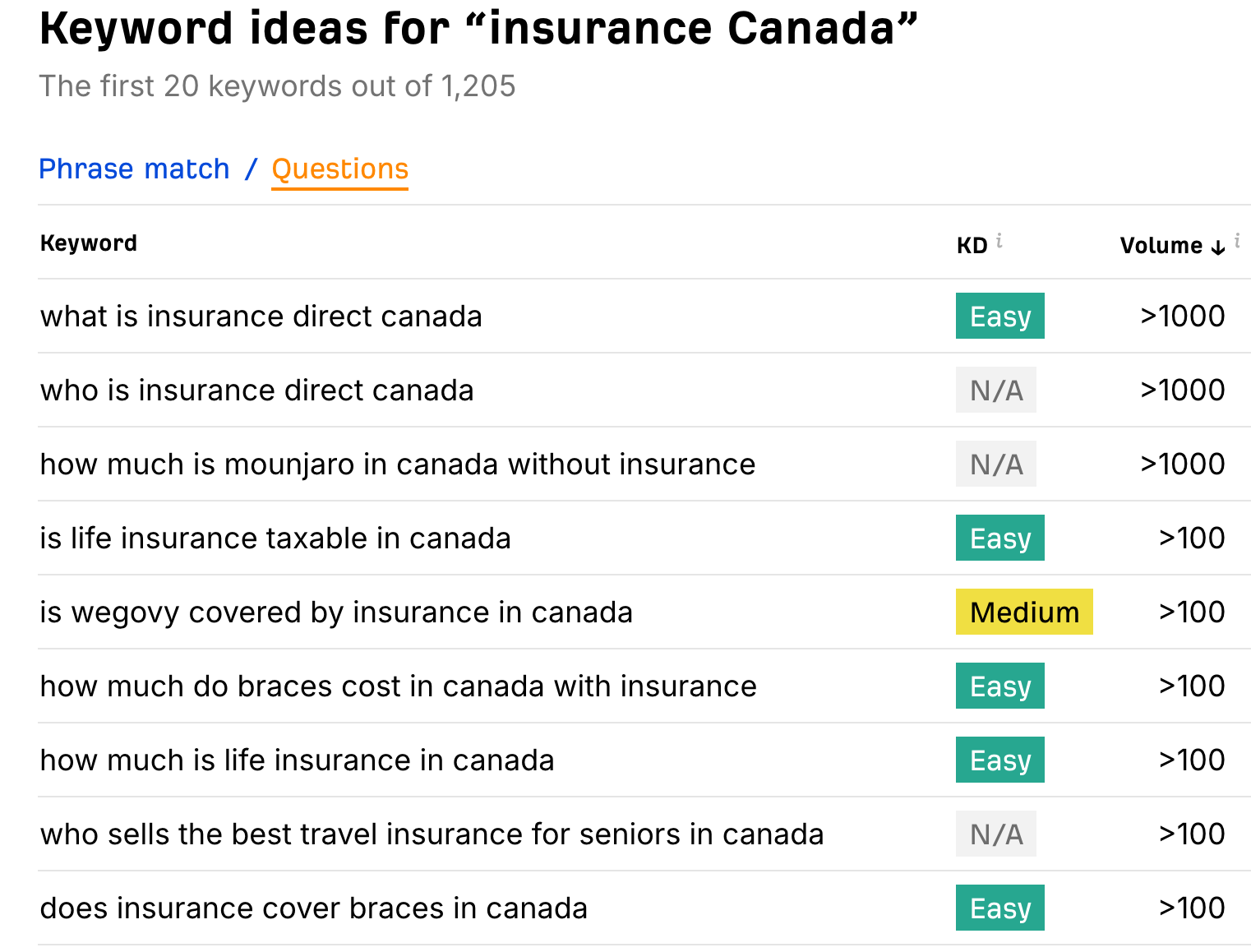

Using Keywords for Health Insurance Marketing

Choosing the right keywords for your website is like using a specific key for a lock; it has to perfectly match what your customer is thinking. Your entire plan for improving search engine rankings depends on understanding what people want, because, as we’ve seen, Google’s search engine is built to reward the most helpful answers.

Your keyword strategy should account for these four main categories of user intent:

- Informational: “What is a deductible in health insurance?”

- Commercial: “Best Health Insurance Companies 2025”

- Transactional: “Buy health insurance online,” “health insurance quotes”

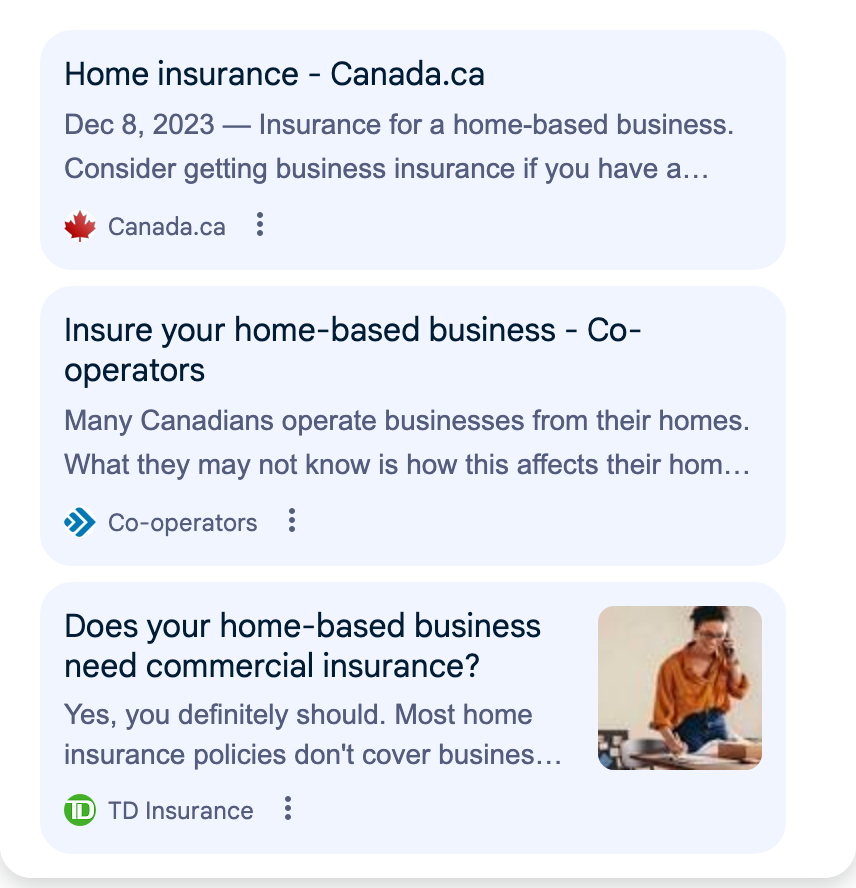

- Geographic/Local: “Insurance near me,” “group benefits plans in Calgary,” “health insurance broker in Halifax”

That last category is where local SEO becomes your best friend, and it’s important to focus on it as “insurance near me” searches have doubled in the last 2 years:

To make sure your local search optimization efforts are right on the money, you can use tools like Ahrefs and Mangools to find the exact local phrases people are typing:

(Image source #8)

This work is what allows your agency to appear in a Google local search result, putting you directly in front of local customers actively seeking help with their Insurance needs.

Leveraging Social Media Marketing for Insurance Companies

Social Media Marketing works differently in insurance because people don’t shop for coverage like they browse for shoes. Social media becomes your relationship-building tool through timely responses to comments and messages, building customer engagement from surface-level likes to meaningful conversations.

Each platform serves different purposes:

- LinkedIn: Share B2B insights like “How Remote Work Changed Commercial Property Insurance” to connect with business owners.

- Facebook: Since many users are aged 30+, it’s perfect for your target demographics who own homes and businesses. Show your local expertise versus impersonal quote aggregators.

- Instagram & TikTok: Use 30-second videos that focus on humor like “Reacting to the wildest insurance claims we’ve seen.”

At Nomadic Advertising, we take the social media management problems off your plate. We’ll help your Insurance company with content creation, community management, and everything in between.

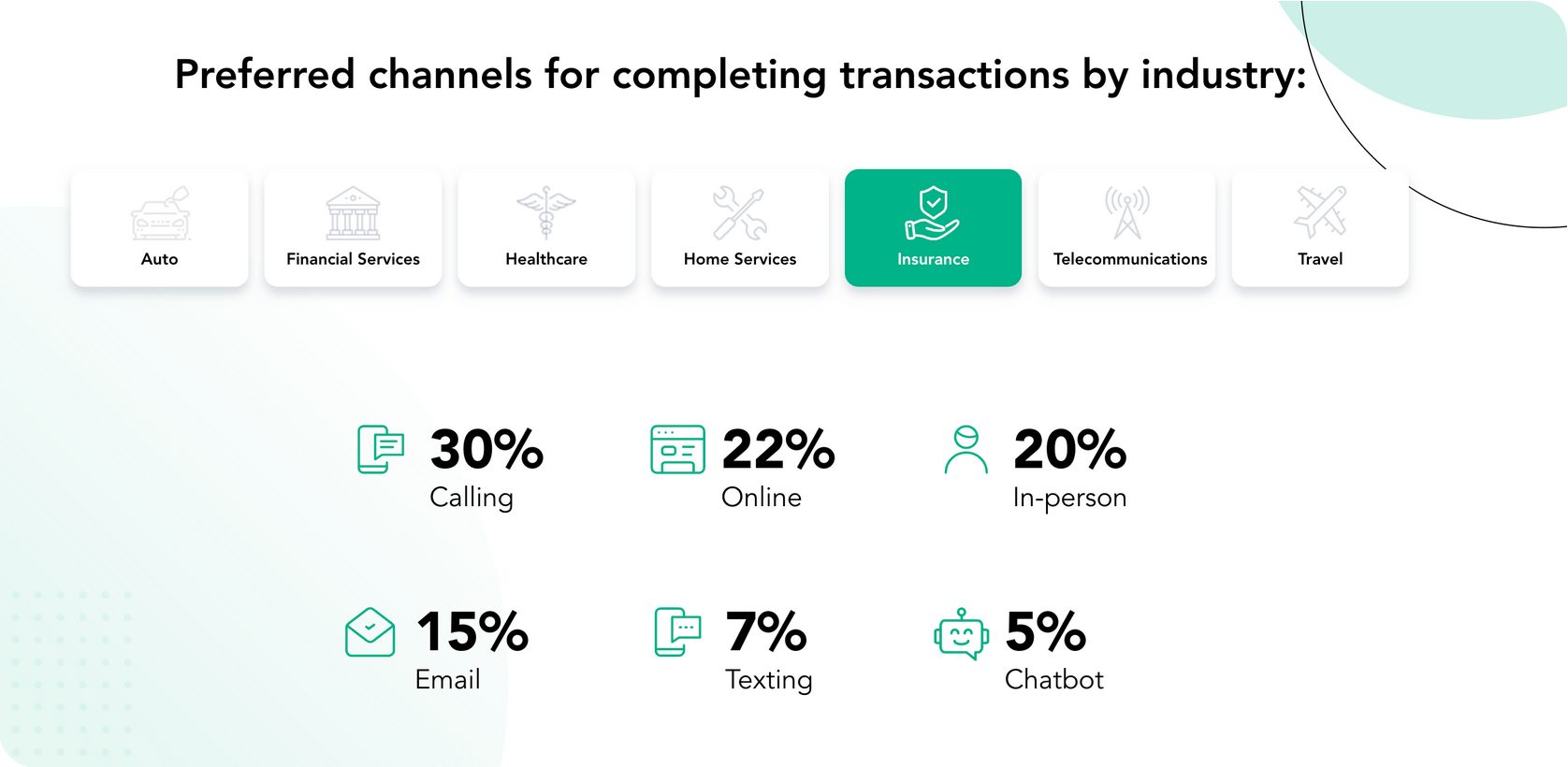

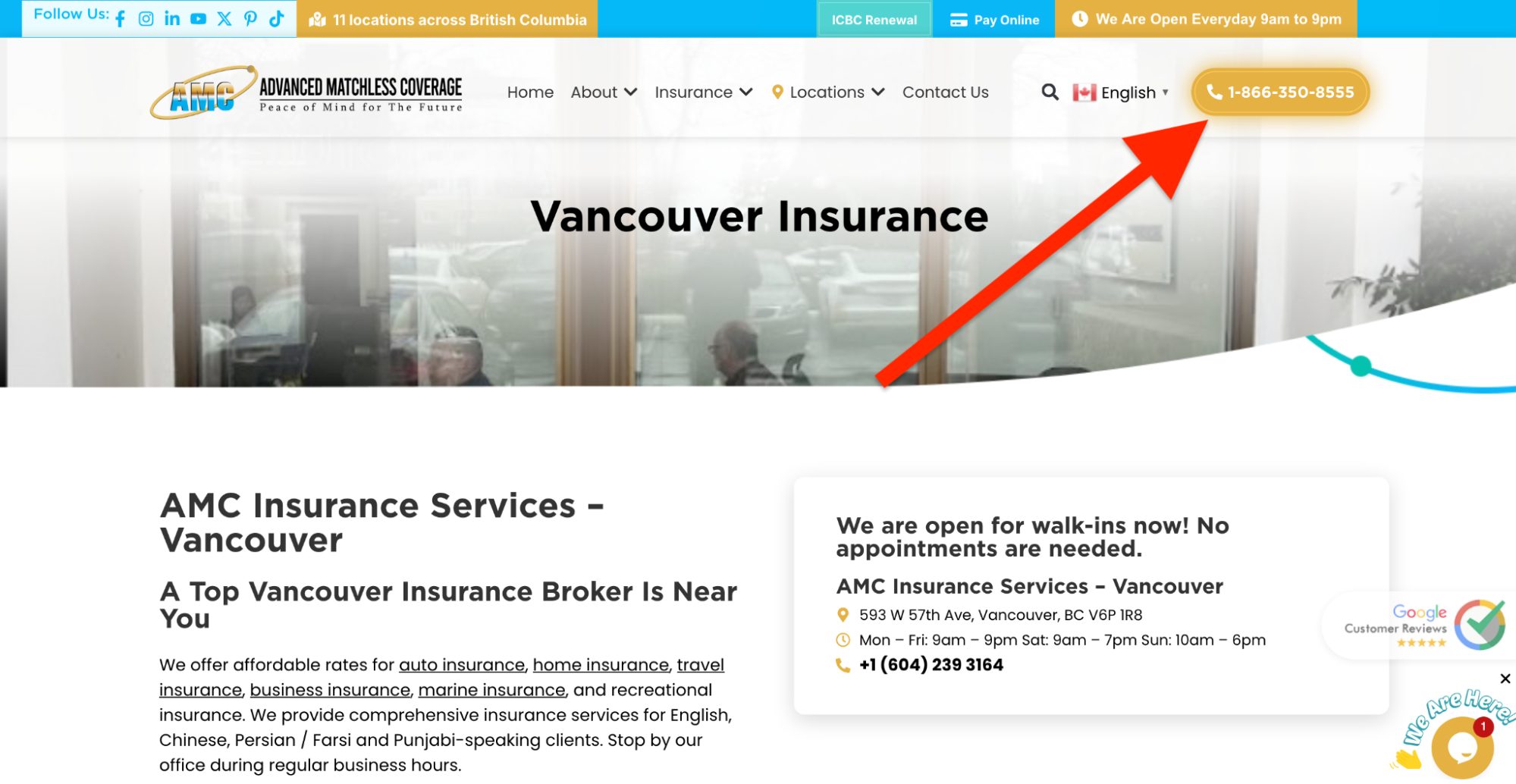

Insurance Agency Website Development: Building a High-Converting Online Presence

Insurance Agency Websites need to work like a good insurance policy: reliable when people need them most. The majority visitors land on your site after hours when your office is closed, so your website design becomes your 24/7 salesperson.

(Imae source #1)

Since 30% of insurance customers prefer calling to convert, your user experience should make that phone number impossible to miss. Like this:

(Image source #9)

Your Website Optimization checklist should also include:

- Trust signals: Customer testimonials, security badges, and professional photos

- Mobile-responsive design: Quote forms that work perfectly on smartphones

- Fast-loading website pages: Nobody waits for slow sites anymore

- Clear navigation: Information within three clicks maximum

Web Design alone won’t cut it, though. Your SEO optimization during development sets the foundation, and submitting your sitemap to Google Search Console after launch ensures search engines can find your new site properly.

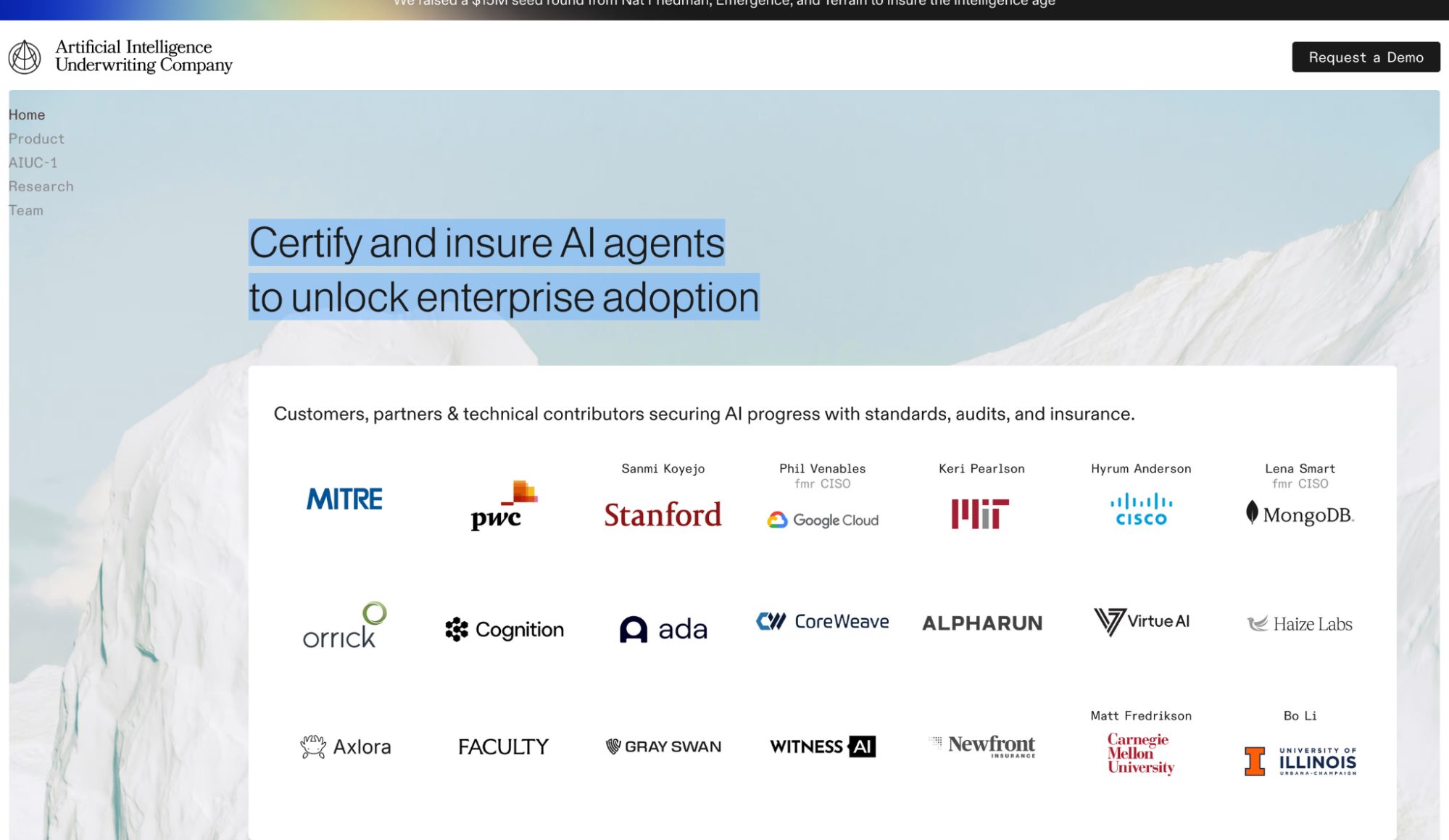

Final insurance agency marketing ideas

Let’s wrap up with some AI-based ideas we believe you should keep an eye on:

(Image #10)

- AI System Insurance Coverage: Your agency might soon offer coverage for when clients’ AI systems make costly mistakes, like when an AI assistant leaks customer data or quotes wrong prices. A company called AIUC (above) is the first to do this, but we believe they’ll be one of many.

- Advanced AI Fraud Detection: Your agency could market AI that analyzes voice patterns, typing behavior, and photo details simultaneously to catch fraudsters that traditional methods miss.

- Complete AI Claims Processing: Your agency might offer end-to-end AI claims handling that goes from “my car got hit” to “here’s your check” without human involvement, marketing the speed advantage. As we saw earlier with Lemonade Insurance, this is something that’s already happening.

Key Takeaways

- 68% of insurance shoppers are undecided when searching. Capture them with personalized insurance ads!

- Insurance ads need clear value propositions, emotional connection, social proof, simple CTAs

- Target local insurance keywords; average insurance customer spends $867 after search

- Facebook insurance marketing needs helpful content, Instagram/TikTok use humor for agency relationship building

- Insurance SEO must target Google’s 2025 AI Overview feature for coverage questions

Looking for Marketing for Insurance Companies?

Getting your insurance agency or company noticed in 2025 means dealing with Facebook’s Special Ad categories, Google’s ever-changing algorithms, and new AI trends reshaping how people find coverage.

At Nomadic Advertising, we’ve spent over a decade mastering these exact insurance marketing challenges. We run your Google Ads, Facebook campaigns, SEO, and social media so the leads keep coming to you.

Contact us today and let’s turn your marketing from a liability into your strongest asset.

Image sources:

1 – https://www.invoca.com/blog/insurance-marketing-statistics

2 – https://blinkparametric.com/blink-parametric-platform/blink-flight-disruption/

3 – https://www.travelers.com/home-insurance/coverage/wildfire-defense

4 – https://www.johnhancock.com/life-insurance/vitality/vitality-rewards.html

5 – https://www.joinroot.com/

6 – https://www.youtube.com/watch?v=MDLn6htCs-E

7 – https://www.facebook.com/ads/library/?id=2120884741714458

8 – https://ahrefs.com/keyword-generator/

9 – https://amcinsurance.ca/vancouver-insurance/

10 – https://aiuc.com/