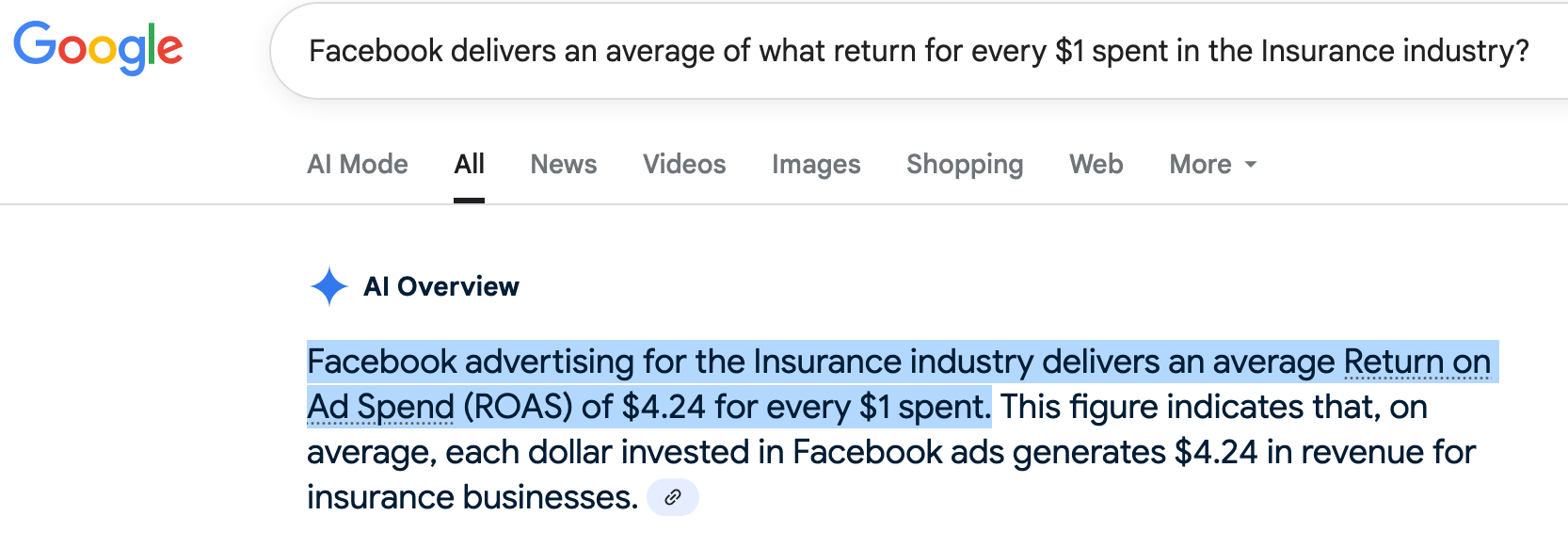

If you could get four dollars back for every dollar spent, you’d want to know how, right?

Our research has found that Facebook advertising for the insurance industry delivers an average Return on Ad Spend (ROAS) of $4.24 for every $1 spent, that’s quite an impressive ROI.

This complete marketing strategy for life insurance professionals covers analyzing real-world Facebook and Google ad examples, building high-converting landing pages that capture qualified leads, organic social media, SEO tactics designed for the new era of AI Overviews, and more.

Let’s show you how to build this system from scratch.

Creating Life Insurance Creative Ads: What You Should Know

Let’s start with the biggest challenge every insurance agent faces. Creating life insurance ads that work means understanding one uncomfortable truth: people don’t want to think about dying. Your job is to make them think about living and protecting what matters most.

Start with emotional triggers that work. The most successful life insurance ads focus on family protection, peace of mind, and financial security rather than policy details.

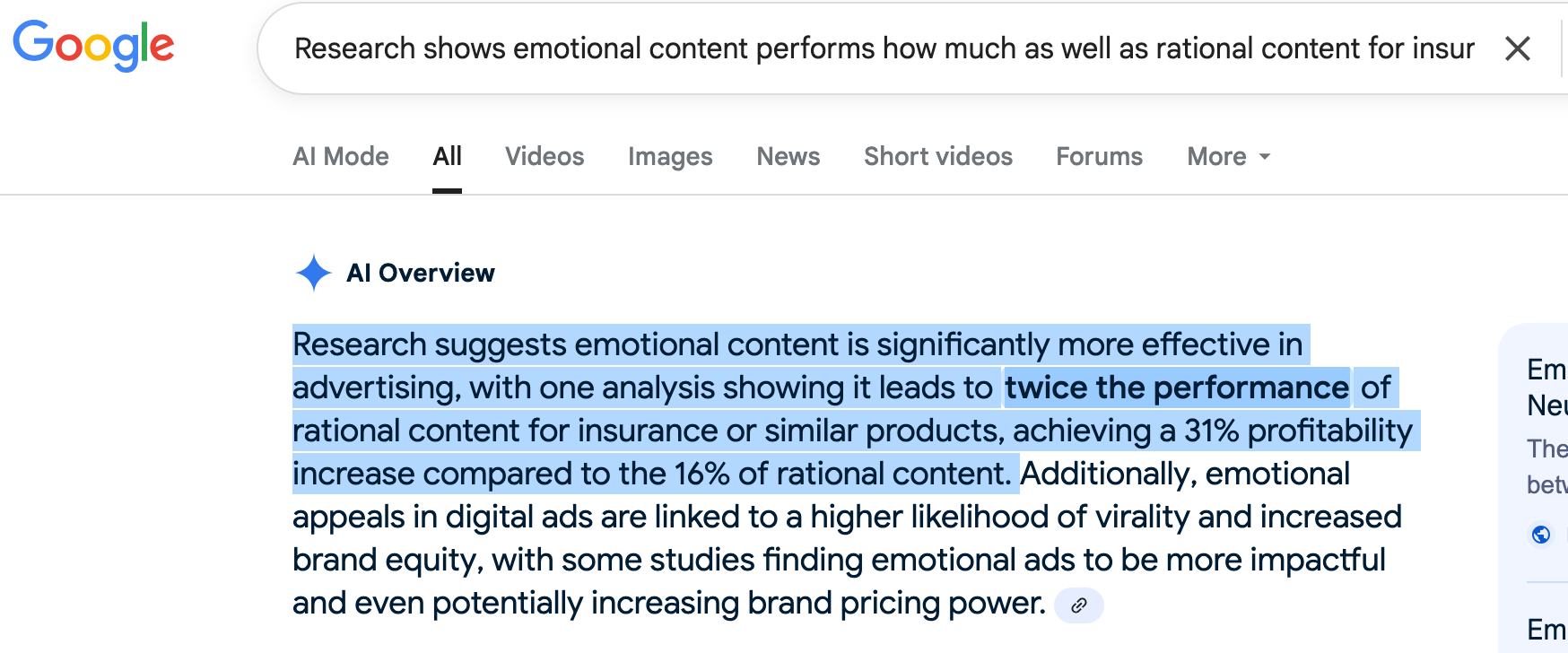

The stats back this up: emotional content can lead to twice the performance of rational content, achieving a 31% profitability increase compared to the 16% from rational approaches.

Your insurance advertisements should follow a problem-solution structure with clear value propositions:

- Don’t lead with price, lead with the benefit

- “Don’t leave funeral costs behind” is likely going to chime better than “Life insurance starting at $13/month”

- Always ensure compliance by clearly identifying your insurer and maintaining honest claims.

These emotional principles become especially powerful when insurance agents apply them to Facebook’s visual storytelling and hyper-targeting capabilities.

Let’s look at this in more detail.

Life Insurance Facebook Ads: Why They Still Work

While digital marketing methods continue to evolve, Facebook ads remain a goldmine for insurance professionals. The finance and insurance industry sees conversion rates as high as 18% on the platform, making it one of the most profitable channels available to agents today.

Since insurance falls under Facebook’s “Special Ad Category,” the targeting rules have changed, but haven’t eliminated your chances. You can no longer target by specific ages (the range is now 18-65+) or pinpoint locations smaller than a 15-mile radius.

But we believe you can use this to open doors to reach prospects you might have otherwise missed.

Pro Tip:

Working within Facebook’s strict insurance category requirements means you’re probably looking at your computer screen with an “Eh?” expression on your face. At Nomadic Advertising, we help you manage your Facebook insurance ads and ensure full compliance with their special category rules.

Life Insurance Facebook Ad Examples That Convert

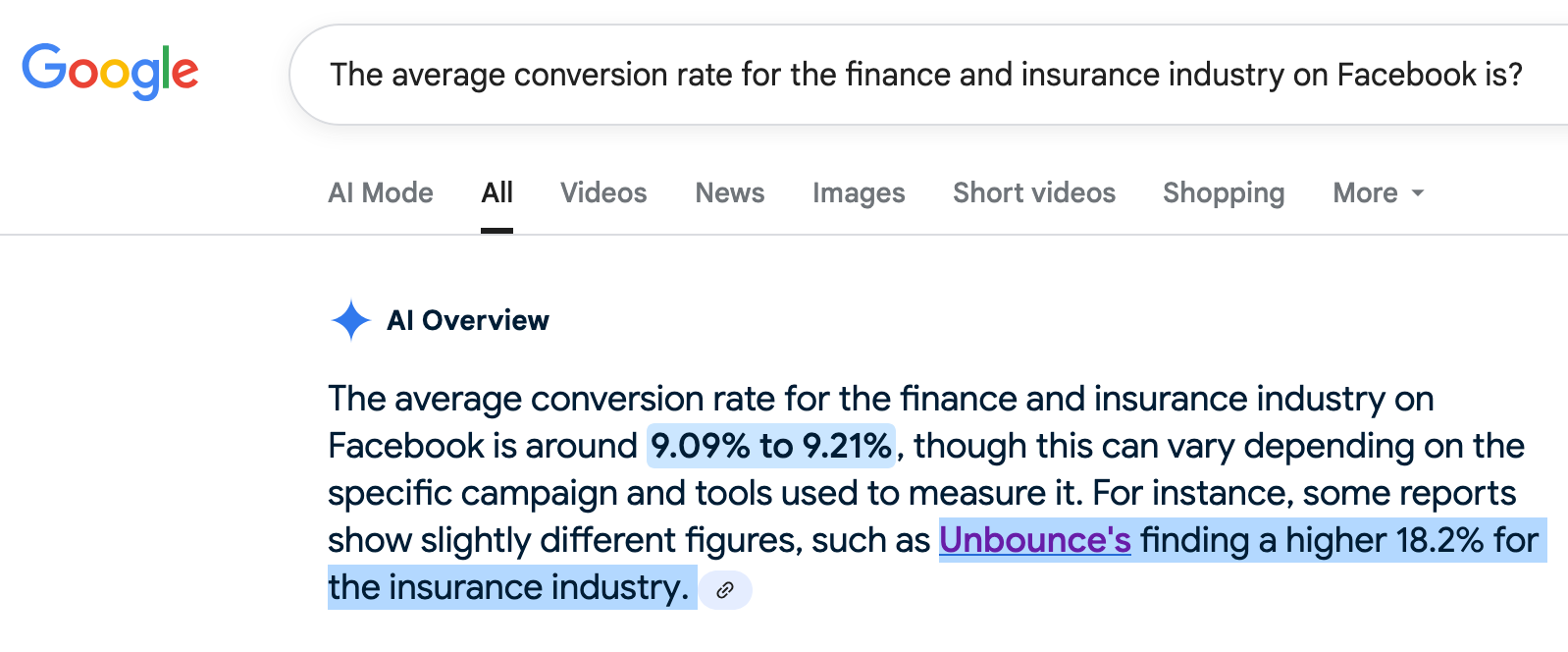

With your targeting strategy dialed in, you need Facebook Ads that convert. Here’s a breakdown of why this Ethos ad works:

(Image source #1)

- It hooks you by immediately questioning the common assumption that $1M in coverage is too much.

- Its flowchart makes the large benefit feel real and practical by connecting it to everyday costs like your mortgage and bills.

- The casual ad copy (“Kinda wild”) and the direct value comparison of $1M for just $54/mo are used to frame the cost as low and reduce user hesitation.

(Image source 1)

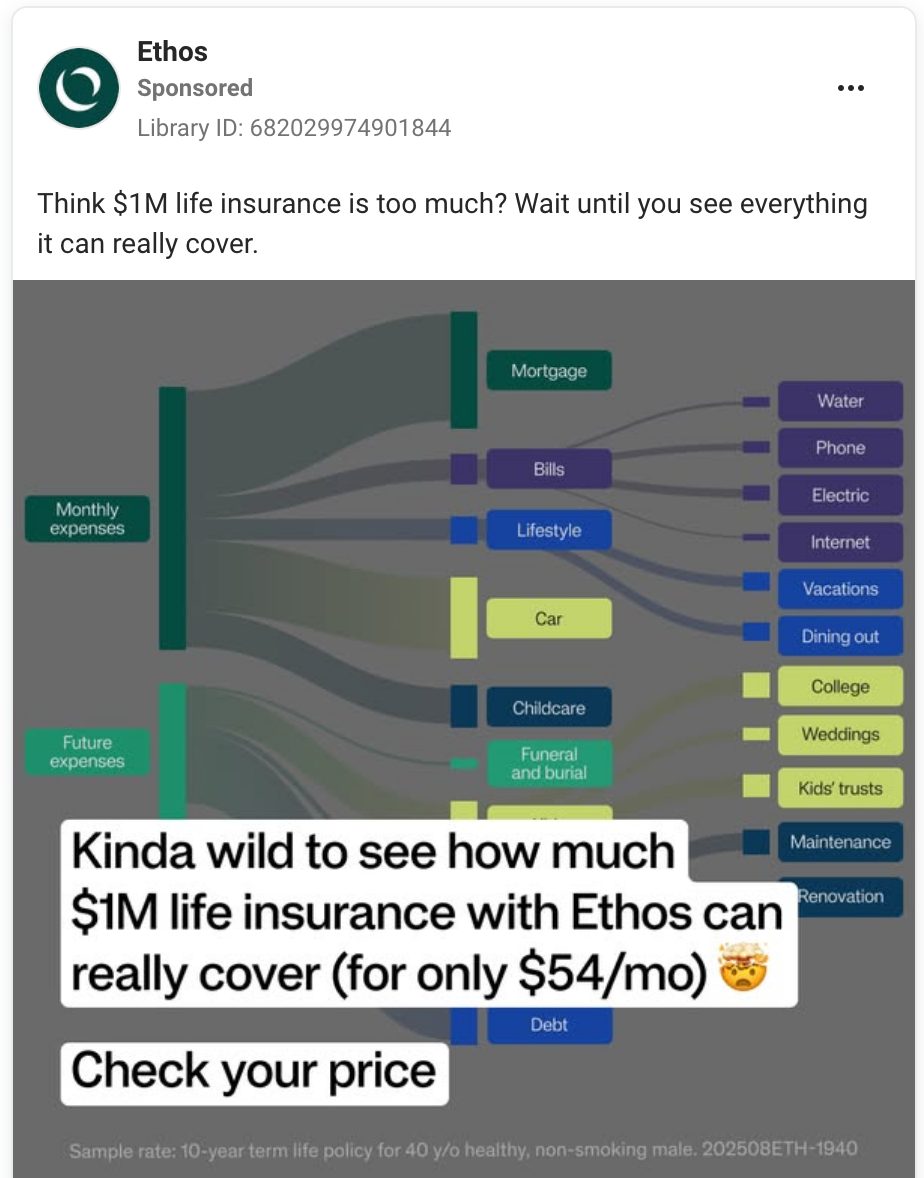

Next, this Fidelity ad builds trust through authority and transparency:

- It promises a quote in “less than 2 minutes,” removing the fear of a complicated process

- The ad establishes instant credibility by highlighting that it’s been “Trusted for over 125 years”

- It provides clear, tiered pricing upfront, giving users concrete information before they click

Life Insurance Facebook Ad Examples That Convert

Next, let’s look at some of the best Facebook Ads for Life Insurance that caught our eye, starting with this one from Christina Rivera.

(Image source #1)

- It tackles key emotional barriers (like the fear of a medical exam) and focuses on a specific client need: having enough money for a funeral

(Image source #2)

- Video gets attention, and our research shows it can generate 480% more clicks compared to images. This ad’s 24-second runtime is also perfect for a user’s busy social media feed

(Image source #1)

Next, here’s why the Athlete Life Insurance ad is a great example of smart targeting:

- Instead of using narrow targeting (which, as we mentioned, is banned for Insurance companies), the ad is shown to a broad “Fitness” interest group. This is a smart way to reach a valuable niche while staying compliant

- The ad’s content, focused on runners and rewarding fitness, acts as a filter. Meta’s AI then learns from who engages and then shows the ad to more people like them

How to Generate Life Insurance Leads on Facebook

Once an ad gets a click, your next challenge is turning interest into a genuine life insurance lead. The method you choose involves a significant trade-off, and there are two schools of thought on what gets the best results.

Path 1: Facebook Lead Forms (Optimized for Low Friction)

The argument for using in-app forms is strong. Research shows that lead generation ads often outperform traffic campaigns for insurance because they capture information directly. The thinking is that this easy process gets you more qualified leads by not losing interested people to extra clicks.

Path 2: Dedicated Landing Pages (Optimized for High Intent)

However, many advertisers find that the highest-quality leads come from a landing page. The reasoning here is that a person willing to visit your site is showing higher intent, and the page gives you the space to build the trust needed before they share sensitive information.

So, what goes into a landing page that successfully builds that trust?

How to Create Life Insurance Landing Pages That Convert

With the insurance industry seeing average landing page conversion rates around 18% (10% above the average), a well-built page offers a huge advantage.

Your page should function like a home’s front door: it must be welcoming in seconds, with a clear value proposition and credibility signals visible immediately.

For a product that requires so much confidence from a buyer, a few key elements can make all the difference.

- Instead of using a long contact form, you can get the ball rolling with the “breadcrumb technique.” Just ask for a ZIP code first before requesting more information.

- To earn a visitor’s confidence, you’ll need prominent customer testimonials and security badges. Highlighting your great customer service and providing clear policy details also helps build that assurance.

Google Ads for Life Insurance: Your Secret Weapon

If Facebook Ads are a megaphone used to broadcast a message to a whole town, then Google Ads is a two-way radio responding to a specific person who just called for help.

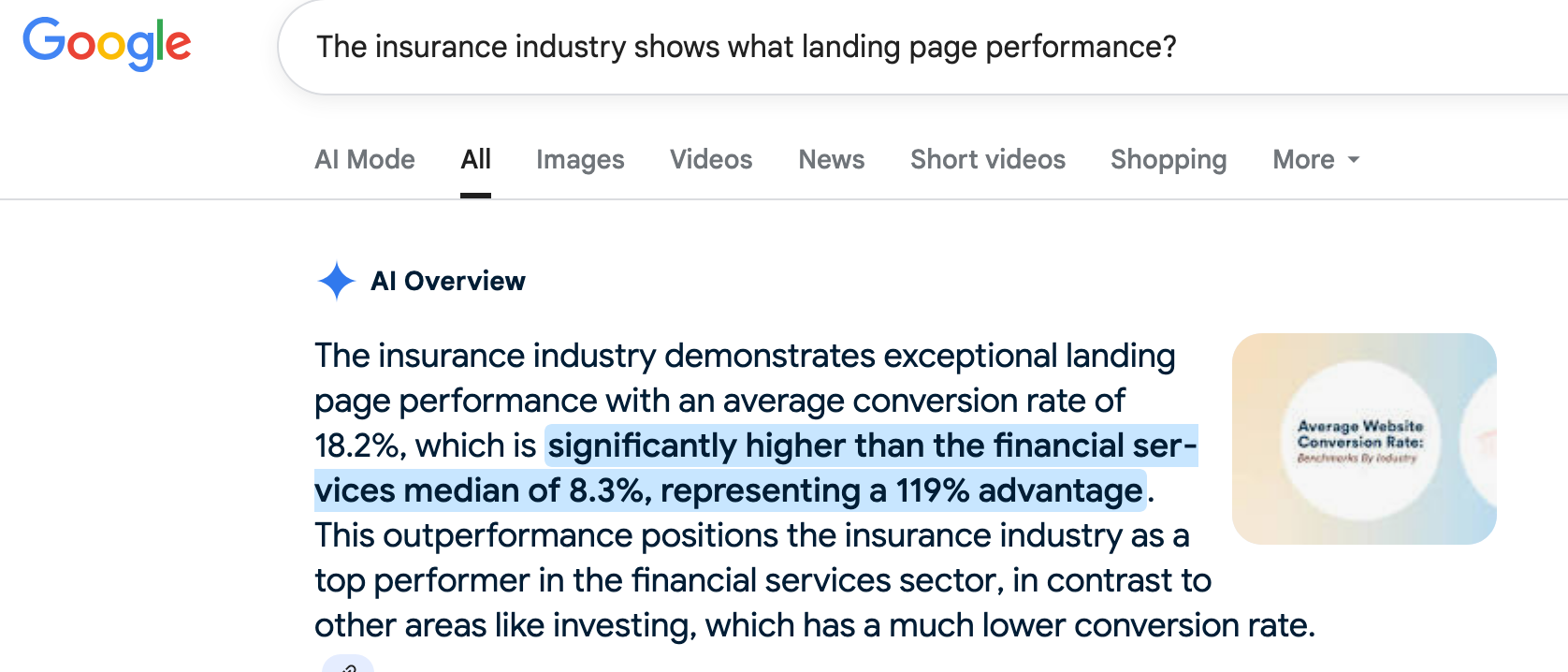

(Image source #3)

You’re engaging in a direct conversation, which is why the finance and insurance industry achieves an impressive 8.33% click-through rate, comfortably above the industry average of 6.5%

Understanding Keyword Intent

Your success with this platform comes down to understanding keyword intent. Someone searching “what is life insurance?” is just kicking the tires. A person typing “best term life insurance rates” or “quotes for final expense insurance,” however, is ready to have a serious conversation with you.

Choosing the Right Campaign for the Job

Search campaigns put your text ads directly on Google search results when people hunt for policies. Display campaigns, meanwhile, spread visual ads across websites to keep your agency front-of-mind between shopping moments.

Pro Tip:

At Nomadic Advertising, we believe the key to a successful Google Ads strategy is focusing your budget on the highest-intent keywords. With over a decade’s experience, we build and manage these specific campaigns to connect you directly with clients actively looking for a policy.

Google Ads Examples for Life Insurance That Perform

Here’s how the Canadian Family Life insurance agency uses this ad to attract potential clients:

- The headline and description work together, matching the search term while repeating “Free No-Obligation.” This reassures nervous buyers and removes the fear of a high-pressure sales pitch

- The ad uses multiple links as a clear call to action, which does two things: it takes up more real estate on the search page, pushing competitors down, and it gives people different choices so they can go directly to what they need

Next, the Instant Life Insurance ad and its calculator are a great example of a modern, trust-building approach.

- The ‘No Medical’ ad hooks a key fear, then the calculator answers the first big question in any life insurance purchase: ‘How much coverage do I need?’

(Image source #4)

- This approach works by giving users control. Interactive tools like calculators are a perfect example of giving value first (a key strategy for high-trust products like insurance), and the research shows this method works with interactive content, boosting conversions by 70%

Final Insurance Advertising Ideas

Here are two final advertising strategies to make your life insurance campaigns more efficient.

First, instead of manual A/B testing, use Meta’s Advantage+ creative. You give its AI different headlines, images, and descriptions, and it automatically finds the best combinations for your digital marketing.

Second, build more targeted retargeting funnels with marketing automation and the Meta Pixel. This lets you show different ads to specific groups:

- Exclude low-interest visitors to save money

- Show testimonials to people who watched your video but didn’t click

- Remind users who abandoned a quote form about their application

From Ads to Ecosystem: Creating a Marketing Strategy for Life Insurance Companies

While capturing attention with ads is the first step, a complete marketing strategy builds on that foundation. Let’s explore how to create a lasting brand presence with organic social media and search engine optimization.

How to Market Life Insurance on Social Media Effectively

Organic social media for insurance is less about direct selling and more about building relationships and establishing yourself as a trusted expert. The approach should be adjusted for each platform.

Facebook:

With its broad user base, Facebook is well-suited for building a community. You can post links to educational blog posts, share client success stories, and answer common insurance questions. The goal is to be a helpful, consistent presence in your followers’ feeds.

Instagram and TikTok:

Both are highly visual platforms, making them ideal for a younger audience seeking a policy from you. Instead of text-heavy posts, you can use short videos (Reels) to show your light side or use multi-image carousel posts to create simple infographics that explain different policy types. The tone should be approachable and human.

LinkedIn:

LinkedIn is the place to establish your expertise and connect with other professionals, which can be particularly useful for marketing group life insurance to businesses. You can share insightful articles on financial planning, participate in industry group discussions, and connect with local business owners.

Examples of Life Insurance Social Media Posts That Get Engagement

Let’s look at a couple of these platforms in action:

1 – Lindsey Smith

(Image source #5)

- Lindsay, an independent life insurance broker, exploded on Instagram with this post, collecting almost 2 million Likes along the way

- In the short video, it shows a man acting as a human buffer between him, his car and a reversing truck (thankfully, he comes out of it fine)

- The accompanying text Lindsay puts over the short video shows how you can use Instagram for your insurance company in a lighthearted, but attention-grabbing way

2 – Kaira | Taxes & Insurance

(Image source #6)

- Meanwhile, Kaira, another independent agent, breaks down just how budget-friendly taking out a life insurance policy is

- She breaks it down monthly, weekly, and then, finally. daily where, at just 70 cents a day, her policies are very affordable. The algorithm and audience loved it, with almost 11k Likes on the post

The Power of SEO for Life Insurance Websites

The power of search engine optimization is that it turns your website into your best salesperson. The reason is intent: people using search are actively looking for solutions for their family, which is why organic leads show an impressive 14.6% close rate, compared to just 1.7% for outbound leads.

Here are two key ways to make SEO work for your website in the insurance industry:

- Build your website into an educational resource. Create pages that answer the real, conversational questions people ask, like “how much life insurance do I need for a mortgage?” This strategy captures high-intent traffic.

- For independent agents, Local SEO is how you compete with the giants. Optimizing your Google Business Profile and creating location-specific pages for your website establishes you as the local authority.

Pro Tip:

This shift toward question-based search is accelerating with the rise of conversational AI. To prepare your business for this future, we built a service that focuses on making your brand the trusted source that AI systems quote and recommend in their answers. Click here to see how we can help you rank in 2025 and beyond.

Key Takeaways:

- Life insurance ads work best with emotional triggers (family protection, peace of mind) vs. policy details, delivers 31% higher profitability

- Facebook Special Ad Category limits targeting but still very profitable (18% conversion rates, $4.24 ROAS)

- Google Ads excel for high-intent searches (8.33% CTR)

- Landing pages need trust signals, testimonials, and match ad promises exactly

- Organic social builds relationships through educational content, not direct selling

Ready to Create a Winning Marketing Strategy for Your Life Insurance Company?

You’ve seen how emotional storytelling beats feature lists, how Facebook’s restrictions become lucrative opportunities, and why Google Ads capture ready-to-buy prospects.

Like a good life insurance policy protects your family’s future, a complete marketing strategy protects your agency’s growth.

At Nomadic Advertising, we specialize in helping life insurance companies build these comprehensive strategies.

Contact us today for a free consultation, and let’s help you underwrite your marketing success.

Sources:

1 – www.facebook.com/ads/library

2 – https://biteable.com/blog/video-vs-image

3 – https://www.wordstream.com/blog/2025-google-ads-benchmarks

4- https://instant-life-insurance.ca/calculator.php

5 – https://www.instagram.com/lindsaysmiththeagent/

6 – https://www.tiktok.com/@itskzo22